In the domain of auto insurance, all-encompassing coverage is often perceived as a safety net for a wide range of unforeseen incidents, yet the specific inclusion of rodent damage remains a topic of considerable debate among policyholders.

This type of coverage, designed to protect against non-collision related incidents, theoretically encompasses damages caused by animals; however, the extent to which it applies to rodent-inflicted harm frequently surfaces as a point of contention.

As we explore the nuances of insurance policies and the criteria under which rodent damage may or may not be covered, it becomes imperative to scrutinize the fine print of all-encompassing coverage plans.

This investigation not only sheds light on the limitations and exceptions of such policies but also guides individuals in maneuvering the complexities of filing a claim for rodent damage, thereby equipping them with the knowledge to safeguard against potential future incidents.

Understanding Comprehensive Coverage

Full coverage, a pivotal component of auto insurance policies, provides financial protection against non-collision-related damages to a vehicle. Within this spectrum, inclusive coverage stands out by offering reimbursement for losses resulting from incidents other than traffic collisions. This includes natural disasters, theft, vandalism, and other unforeseen events that might affect the vehicle’s integrity. The inclusion of inclusive coverage in an auto insurance policy guarantees a broader safety net for vehicle owners, safeguarding their investments from a variety of risks.

Determining the appropriate level of inclusive coverage necessitates an understanding of deductible amounts and coverage cost, two critical factors that greatly influence the policy’s effectiveness and affordability. Deductible amounts refer to the money a policyholder is required to pay out-of-pocket before the insurance coverage kicks in. Higher deductible amounts usually result in lower monthly premiums, but they also mean more financial responsibility for the policyholder in the event of a claim. Conversely, lower deductible amounts may increase the premium but reduce the financial burden after an incident.

The coverage cost, meanwhile, is influenced by several variables, including the vehicle’s value, the policyholder’s driving history, and the geographical area’s risk profile. Insurers calculate these costs to determine the premium rate, making sure it reflects the level of risk they are undertaking by insuring the vehicle. It is essential for consumers to carefully assess these factors when selecting inclusive coverage, balancing the need for adequate protection with the desire for an affordable policy.

The Scope of Rodent Damage

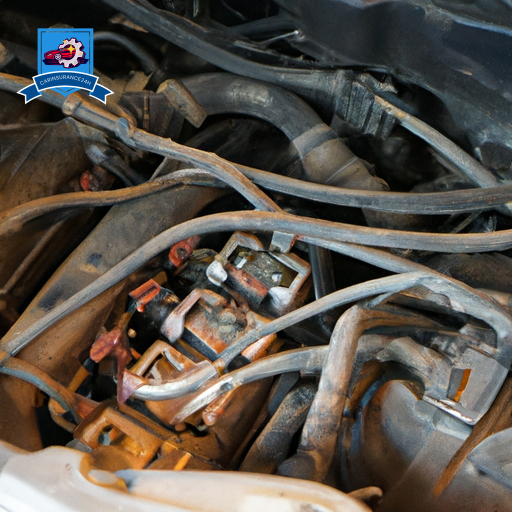

Understanding the various risks covered under inclusive coverage, it becomes imperative to examine the impact of rodent damage on vehicles, a concern that often goes unnoticed. Rodents, including rats, mice, and squirrels, can cause significant harm to vehicle components, leading to costly repairs and operational failures. These creatures are attracted to the shelter and warmth that parked vehicles provide, making cars a prime target for nesting and gnawing activities.

The scope of rodent damage extends beyond superficial harm, affecting critical vehicle systems. Rodents possess strong teeth that can cut through wires, rubber, and plastic components, leading to electrical failures and fluid leaks. The insulation materials and soft fabrics within cars also present an ideal nesting material for these pests, further encouraging their destructive behavior.

Identifying the signs of an infestation early can mitigate the extent of the damage. Key indicators include:

- Visible gnaw marks on wires and hoses

- Nesting materials found under the hood or in hidden compartments

- Unusual noises or odors emanating from the vehicle

Vehicle owners must remain vigilant for these infestation signs, as rodent species are adept at remaining hidden within the confines of a car. The consequences of their presence can range from minor inconveniences to major system failures, necessitating comprehensive coverage that addresses such unpredictable risks. Understanding the behaviors and potential impact of rodent species on vehicles is vital for maintaining the integrity and functionality of one’s automobile, underscoring the importance of inclusive insurance policies that cover such eventualities.

Coverage Limitations and Exceptions

While full coverage insurance policies offer protection against rodent damage, they frequently come with specific limitations and exceptions that policyholders must be aware of. It is imperative for individuals holding these policies to understand the extent and limitations of their coverage to avoid unforeseen circumstances where claims may be denied.

One significant limitation pertains to the causation of the rodent damage. For instance, if rodents cause harm to a vehicle or property as a direct result of weather-related damage, such as seeking shelter during a flood or storm, some policies may not cover the damage. The distinction lies in the interpretation of the original cause of damage; while weather-related damage is often covered under all-encompassing policies, the subsequent rodent damage might not be.

Moreover, the aspect of accident liability introduces another layer of complexity. If rodent damage contributes to an accident, there might be limitations regarding the coverage depending on the specific circumstances and the direct cause of the accident. Insurance companies meticulously assess the chain of events leading to the accident to determine liability and whether the damages fall under the purview of the all-encompassing coverage.

Filing a Claim for Rodent Damage

Upon discovering rodent damage, property owners must initiate the claim process by thoroughly evaluating the extent of the damage.

It is critical to review the insurance policy to understand the coverage specifics related to such damage.

Subsequently, documenting the damage thoroughly becomes imperative for submitting a successful insurance claim.

Assessing Rodent Damage Extent

Before filing a claim for rodent damage, it is important to accurately assess the extent of the damage incurred. This initial evaluation is critical for two main reasons: rodent identification and estimation of damage repair costs. Identifying the type of rodent responsible can provide insight into the extent and nature of the damage, as different species may affect various parts of a property or vehicle differently. Understanding the full scope of damage is essential for accurately reporting to an insurance company.

- Rodent identification: Determines the type of rodent to understand the damage patterns.

- Damage repair costs: Estimating the financial impact is critical for filing a thorough claim.

- Documentation: Collecting evidence of the damage supports your claim process.

Insurance Policy Coverage Check

To effectively file a claim for rodent damage, policyholders must first verify the specific coverages and exclusions detailed in their insurance policy. Understanding these details is essential, as not all policies automatically cover such damages. Consideration of policy upgrades may be necessary if the current coverage is insufficient. Additionally, understanding the deductible impacts is vital, as this influences the out-of-pocket expense for the policyholder.

| Factor | Importance | Note |

|---|---|---|

| Specific Coverages | High | Confirm if rodent damage is included |

| Exclusions | Critical | Identify any specific exclusions |

| Deductible Impacts | Significant | Assess how the deductible affects claim viability |

Evaluating these aspects ensures that policyholders are adequately prepared to file a claim for rodent damage.

Documenting Damage for Claims

Having verified the specific coverages and exclusions in the insurance policy, policyholders must meticulously document all rodent damage to guarantee a successful claim process. This documentation serves as integral evidence that validates the extent of the damage and its resultant repair costs. It not only facilitates the assessment process for insurers but also delineates the legal responsibilities of all parties involved.

To verify detailed documentation:

- Take detailed photographs of all areas affected by rodent damage.

- Compile repair estimates from licensed professionals to quantify the repair costs.

- Maintain a record of communication with the insurance company, including dates and summaries of conversations.

This structured approach to documenting damage greatly enhances the likelihood of a favorable resolution to claims related to rodent damage.

Preventing Future Rodent Incidents

Implementing robust prevention strategies is essential in mitigating future rodent incidents. As property owners or managers, the emphasis on preventative measures cannot be overstated, as these efforts greatly reduce the likelihood of rodent infestations and the subsequent need for claims under thorough coverage.

The first line of defense involves the use of natural deterrents coupled with rigorous cleaning tips to create an environment that is less attractive to rodents.

Natural deterrents such as peppermint oil, clove oil, or even the presence of certain plants like mint, can effectively repel rodents without the need for harsh chemicals. Placing these deterrents around potential entry points and areas of previous infestations can serve as a significant barrier to rodents. Additionally, maintaining a clean environment is vital. This includes regular disposal of garbage, sealing food in rodent-proof containers, and removing clutter where rodents may nest. Ensuring that the property is devoid of food scraps and standing water eliminates the resources that attract rodents, thereby reducing the chances of their return.

Furthermore, structural maintenance plays a pivotal role in preventing future rodent incidents. This involves sealing cracks and holes in walls, foundations, and around doors and windows with rodent-proof materials. Ensuring that vents are covered with mesh screens and repairing damaged roofing can also prevent rodents from gaining access to the property.

Case Studies and Real-Life Scenarios

Several case studies and real-life scenarios have demonstrated the effectiveness of thorough rodent damage coverage and prevention strategies. These instances not only highlight the financial implications of rodent infestations but also underscore the critical importance of implementing robust pest control strategies to mitigate health risks and property damage. In evaluating these cases, a pattern emerges, underscoring the value of all-inclusive insurance coverage in conjunction with proactive pest management measures.

One notable case involved a homeowner who discovered extensive wiring damage caused by rodents. The all-encompassing coverage facilitated not only the repair of the physical damages but also supported the homeowner in implementing advanced pest control strategies to prevent future incidents. This scenario underscores the multifaceted approach required to effectively combat rodent damage, encompassing both immediate repair needs and long-term prevention measures.

Another scenario detailed the experience of a business owner who faced significant inventory loss due to rodent contamination. The all-inclusive insurance coverage played a pivotal role in mitigating the financial burden, enabling the business to recover while reinforcing the necessity of stringent pest control measures to safeguard against future health risks and financial losses.

These real-life examples highlight several critical points:

- The indispensability of all-inclusive insurance coverage in providing financial protection against rodent damage.

- The integral role of pest control strategies in preventing future infestations and associated health risks.

- The importance of a proactive approach in addressing potential vulnerabilities to rodent damage, thereby minimizing financial and health-related repercussions.

Frequently Asked Questions

How Does the Presence of Rodents Affect My Car’s Resale Value, and Does Insurance Help Mitigate This Depreciation?

Rodent damage can greatly decrease a car’s resale value by up to 25%. Insurance may offer partial mitigation, but adopting preventive measures and strategic resale strategies are essential for minimizing financial loss and depreciation.

Can I Claim for Rodent Damage if the Infestation Occurred Due to the Car Being Parked for an Extended Period?

Claims for rodent damage resulting from prolonged parking may be considered, contingent upon the implementation of preventive measures and the choice of parking locations. It’s advisable to consult your insurance policy for specific coverage details.

Are There Any Insurance Providers That Offer Specialized Rodent Damage Coverage as an Add-On to Comprehensive Policies?

Several insurance providers offer specialized rodent damage coverage as an add-on to inclusive policies, albeit with specific policy exclusions and coverage limits. It is advisable to consult individual insurers for detailed information regarding these provisions.

How Do Different Types of Rodent Repellents Impact My Eligibility for Coverage or Claims Process?

The utilization of natural deterrents and the effectiveness of repellents may influence one’s eligibility for coverage or the claims process. It is essential to understand how these factors are assessed by insurance providers.

Is There Any Legal Recourse Against Municipalities or Neighbors if Their Actions Indirectly Contribute to a Rodent Infestation Causing Damage to My Vehicle?

Legal precedents suggest that individuals may seek recourse against municipalities or neighbors if their actions indirectly lead to rodent infestation damage. Neighbor mediation is often the first step, aiming to resolve disputes amicably and effectively.