When it comes to securing your vehicle in Coralville, Iowa, understanding auto insurance quotes is essential. The diverse range of factors influencing insurance premiums can be perplexing, from your driving record to the type of coverage needed. Knowing how to effectively compare quotes and explore options from top insurance providers in Coralville is a wise step towards finding the best coverage at best rates. Additionally, the advantages of engaging with local insurance agents for personalized assistance and tailored policies cannot be overlooked.

Importance of Auto Insurance Quotes

Securing auto insurance quotes is an important initial step in safeguarding your vehicle and financial well-being in Coralville, Iowa. Understanding coverage options and insurance requirements is vital in ensuring that you are adequately protected in case of any unforeseen events.

When obtaining auto insurance quotes in Coralville, it is essential to have a clear understanding of the coverage options available. Liability coverage is mandatory in Iowa, covering property damage and bodily injury that you may cause to others in an accident. Additionally, uninsured and underinsured motorist coverage is also required, providing protection if you are involved in an accident with a driver who lacks sufficient insurance.

Comprehending the insurance requirements specific to Coralville, Iowa, enables you to tailor your coverage to meet legal obligations and adequately protect your assets. By obtaining multiple insurance quotes, you can compare coverage options, deductibles, and premiums to find a policy that best suits your needs and budget.

Factors Affecting Insurance Premiums

Understanding the various factors that influence insurance premiums is essential for making informed decisions when selecting an auto insurance policy in Coralville, Iowa. Two key factors that impact insurance premiums are driving behavior and vehicle type.

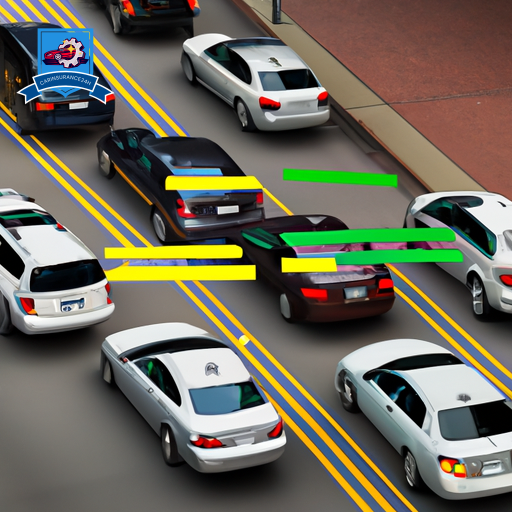

Driving behavior plays a critical role in determining insurance premiums. Insurance companies often consider factors such as the driver’s history of accidents, speeding tickets, and other traffic violations. A clean driving record with no incidents typically results in lower insurance premiums, as it indicates a lower risk of future claims. On the other hand, drivers with a history of accidents or violations may face higher premiums due to the increased likelihood of filing claims in the future.

The type of vehicle being insured is another important factor in determining insurance premiums. Insurance companies assess the make, model, age, and safety features of the vehicle to calculate the risk associated with insuring it. Vehicles that are more expensive to repair or replace, or those with a higher likelihood of theft, may result in higher insurance premiums. Additionally, vehicles with advanced safety features that reduce the risk of accidents may qualify for discounts on insurance premiums.

How to Compare Insurance Quotes

When comparing insurance quotes, understanding the different coverage types available is important. Additionally, it is vital to take into account various pricing factors that can impact the overall cost of your insurance policy. By examining these points closely, you can make an informed decision when selecting the right insurance coverage for your needs.

Coverage Types Explained

How do different coverage types in auto insurance affect the process of comparing insurance quotes? When comparing insurance quotes, understanding the coverage types is important. Two essential factors to take into account are policy limits and deductible options. Policy limits refer to the maximum amount your insurance company will pay out for a covered claim. Higher limits typically result in higher premiums but offer more extensive protection. On the other hand, deductible options are the amount you must pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but it means you’ll have more upfront costs in the event of a claim. Evaluating these coverage types is crucial when comparing auto insurance quotes in Coralville, Iowa.

Pricing Factors to Consider

One key aspect to ponder when comparing insurance quotes is the range of pricing factors that can greatly impact the overall cost of coverage. Factors such as driving record and vehicle age play a significant role in determining the insurance premium. Here are five key pricing factors to ponder:

- Driving Record: A clean driving record with no accidents or traffic violations typically results in lower insurance premiums.

- Vehicle Age: Newer vehicles may require higher premiums due to their higher value and repair costs.

- Annual Mileage: The more you drive, the higher the risk of accidents, potentially leading to increased premiums.

- Location: Urban areas with higher rates of accidents or theft may result in higher insurance costs.

- Coverage Limits: Higher coverage limits can lead to higher premiums but offer greater protection in case of an accident.

Top Insurance Providers in Coralville

Among the top insurance providers in Coralville, a leading company known for its competitive rates and excellent customer service is XYZ Insurance Agency. Customers consistently praise XYZ Insurance Agency for its dedication to meeting their needs and providing reliable coverage. Online tools offered by XYZ Insurance Agency make it convenient for clients to manage their policies and claims efficiently. The agency’s commitment to customer satisfaction is reflected in the positive customer reviews it has received.

To give you an overview of some of the top insurance providers in Coralville, here is a comparison table highlighting key features:

| Insurance Provider | Competitive Rates | Customer Service |

|---|---|---|

| XYZ Insurance Agency | Yes | Excellent |

| ABC Insurance Co. | No | Average |

| LMN Insurance Group | Yes | Good |

Tips for Getting Affordable Quotes

To secure cost-effective auto insurance quotes in Coralville, Iowa, considering various strategies can help you find the most affordable options while maintaining adequate coverage. When seeking affordable quotes, keep the following tips in mind:

- Discount Opportunities: Look for insurance companies that offer discounts for various reasons such as safe driving records, multiple policies, good student discounts, or vehicle safety features. These discounts can greatly reduce your insurance premium.

- Comparison Websites: Utilize online comparison websites to quickly compare quotes from multiple insurance providers. These platforms can help you identify the most competitive rates available in Coralville.

- Payment Options: Inquire about different payment options offered by insurance companies. Some may provide discounts for annual payments or auto-pay arrangements, which can lead to overall savings.

- Customer Service: Assess the customer service reputation of insurance companies. Opt for insurers known for excellent customer service as they can provide assistance promptly and efficiently, ensuring a smooth experience in case you need to make a claim.

- Policy Customization: Consider customizing your policy to suit your specific needs. By tailoring your coverage limits and deductibles, you can find a balance between affordability and adequate protection.

Benefits of Local Insurance Agents

Local insurance agents in Coralville, Iowa offer personalized guidance and tailored coverage options to meet the specific needs of residents. By choosing a local agent, individuals can benefit from a more personalized service that takes into account their unique circumstances and preferences. These agents have a deep understanding of the community and can provide expert advice on the most suitable insurance policies available.

One of the key advantages of working with local insurance agents is the personalized service they offer. Unlike larger insurance companies, local agents take the time to get to know their clients on a personal level, enabling them to recommend coverage options that are tailored to each individual’s needs. This personalized approach can help residents feel more confident in their insurance decisions and assure they have the coverage they need when it matters most.

Additionally, local insurance agents in Coralville, Iowa provide expert advice based on their knowledge of the local market and regulations. Their insights can be invaluable in helping residents navigate the complexities of the insurance process and make informed choices about their coverage. By leveraging the expertise of local agents, residents can secure reliable insurance protection that meets their specific requirements.

| Benefits of Local Insurance Agents | |

|---|---|

| Personalized Service | Tailored Coverage Options |

| Expert Advice | Community Understanding |

Frequently Asked Questions

Are There Any Specific Discounts Available for Residents of Coralville, Iowa When It Comes to Auto Insurance Quotes?

Discount eligibility for Coralville, Iowa residents regarding auto insurance quotes may vary based on factors like driving record, age, and bundling policies. Cost-saving strategies include inquiring about good student discounts, safe driver programs, and multi-vehicle incentives.

How Does the Weather in Coralville Impact Auto Insurance Premiums?

Weather conditions in Coralville, particularly hailstorms and harsh winter driving conditions, can lead to an increased frequency of claims, affecting auto insurance premiums. Insurers may adjust rates based on the elevated risk posed by these weather events.

Are There Any Unique Driving Laws or Regulations in Coralville That Could Affect Insurance Rates?

Traffic patterns and driving habits in Coralville, Iowa play an important role in influencing insurance rates. The area’s road infrastructure, coupled with accident statistics, highlights the significance of understanding and adhering to unique driving laws and regulations to mitigate risks and guarantee appropriate coverage.

What Is the Average Response Time for Insurance Claims in Coralville?

Just as a skilled conductor orchestrates a symphony, insurance companies in Coralville aim towards swift average response times for claims. Prioritizing efficiency leads to heightened customer satisfaction and streamlined processes.

Are There Any Local Auto Repair Shops in Coralville That Are Preferred by Insurance Providers for Claims?

Local garages in Coralville, Iowa, may be preferred by insurance providers for claims due to established relationships, quality workmanship, and timely service. Repair shops aligned with preferred providers often streamline the claims process for policyholders.